Are you ready to check your bank account and scream

“HELL YESSSSS!!”

Of course you are, and I’m here to teach you how to turn

$5,000 into a $1 million net worth

(no illegal activities, pyramid schemes or wild routines required…I promise)

It’s time claim the financial freedom you deserve

You should not be working for your money, your money should be working for YOU

You’re a BADA*S who is ready to step into your power and take control of your finances and your life. You are BUSY, you have dreams, goals, families, jobs, responsibilities and 150 million different things that are maxing out your mental capacity on the daily. (It seriously feel that way sometimes doesn’t it?!) Add on-top of that trying to figure out how to invest, where to invest, how to max out your retirement account, leverage debt etc. and you probably feel like you’re trying to brush your teeth while eating oreos.

Financial stress and uncertainty can be swapped for financial clarity leading to time freedom, choices, resources and the opportunities you crave.

You know in your soul your life is NOT meant to be ordinary.

An extraordinary life requires resources (aka money) which means financial stability is the KEY to it all.

Que the overwhelm right?! Not so fast…it is possible to get your money under control and it’s easier than you think when you have the right person (me) to guide you. I took my 15 years of money making strategy, financial education and wealth building success and am going to teach you everything about money that you didn’t learn in school.

The truth is, you NEED to be in control of your money to be in control of your life. I know that feels easier said than done, and I bet this resonates with you:

You have tried to piece together financial advice and ended up overwhelmed and unsure. “Just don’t buy iced coffees, Don’t use credit cards! Save your money!” (Sip that latte sis, that’s not the secret.)

You are a planner in your day to day, but when unexpected things come up like bills, job loss, medical expenses or trips you scramble to find the extra cash. These blips throw you off, and it’s hard to get back on track and stress takes over. You always feel like you’re one step behind and will never actually get ahead.

The idea of investing is really overwhelming (Stocks?! Mutual funds?! WTF?!) so you’ve just kept your money in a bank account, and while you continue to grow and evolve your money hasn’t. You feel like you’re stuck in a hamster wheel with no way off.

You work your butt off and your job offers some retirement benefits, but you have no idea how to choose a plan, how to determine the right tax advantages and how to actually make money in these accounts. The hard truth is this means you are losing THOUSANDS in compensation that you deserve.

You want to buy a house, but all you hear about are high interest rates, high home prices and you feel completely stressed about how to save for a down payment. The “American Dream” has become more of a nightmare.

Meet Ashlee

Meet Ashlee

I don’t have a trust fund, but I got Rich anyways and it wasn’t by ditching iced coffees. The best part? You can get rich too, and I know that because I am you. I’ve been in your shoes wanting more, craving more and being willing to do whatever it takes do get myself there. I had no CLUE how to make it happen when I started, but with the strategies I learned and now will teach you I changed my financial future forever.

What does that look like? Here are a few highlights:

-

I had it all…student loans, credit cards, car payment and no savings. I grew my wealth a few hundred $$ at a time into a 7-figure net worth without giving up things I loved. (coffee, travel etc.)

-

Fresh out of college I could only afford to contribute $60 a month to my retirement account. Before long, I was maxing out my IRA each year growing my account to 5 figures then 6 and beyond. Hell, I'm making money while I type this. Don't worry. I'll show you how so you can do it too.

-

I started just like everyone else, 1970’s apartment (with the occasional cockroach) to multiple properties by 30, and I am actively looking to buy more in 2024.

-

I started at the bottom and worked my ass off learning all I could on someone else dime so when opportunity came knocking, I was ready. I now own and run a large commercial finance company in addition to a real estate investing and multiple side businesses. AKA I live and breathe money and wealth every day.

Only 33% of Millionaires in the U.S are women, it’s time to change that starting with YOU

Welcome to the 6 Module full financial plan to take you from unsure how to grow your wealth to full control of your life. I will teach you WHAT to with your money, WHEN to adjust your strategy, WHY these steps are important, WHERE to keep that coin, and HOW to grow your net worth a few hundred $$ at a time on your way to a 7-figure net worth and beyond.

Module One

Intro to Finances: We are destroying all the myths you’ve been told about women and money (it’s not for you, let a man in your life handle it, money is complicated) and revealing the mindsets and steps to achieve your fullest potential. The foundation is a critical part a lot of people (and education) skip over. We will cover the plan, mindset and goal setting steps to start you out on the right foot.

HOT TIP: It doesn’t happen by figuring out some weird special trick or waking up at 5 am and sitting in an ice bath (but no hate if that’s your thing)

-

A personal financial plan is like your financial north star. It helps you reach your money goals, manage your cash, and stay on track no matter what unexpected life circumstance comes your way.

-

Instead of focusing on having to work for your money, we are shifting our focus to finding ways to make your money work for YOU.

-

Imagine you're planning a trip across Europe. You wouldn't just book a flight randomly and figure out where to go once you get there would you? Nope, you'd pick a starting destination and map out your route. Setting financial goals is a bit like picking your travel spot.

-

Analyzing your current financial situation is a crucial first step in creating a solid financial plan. We need to set the foundation so we can build upon it, both in our skills and in our wealth.

Module Two

Build Your Budget: Now that we have our foundational pieces, it’s time to build up on them by establishing a monthly budget. Before you think - Snore, I’ve heard this all before I am NOT going to just say “look at your income and subtract your bills!” (BORING)

Instead, we work towards GOALS. “I have my eye on a yoga retreat in Morocco that costs $3,500. How many months will it take to afford it, and how can I speed that up without having to work more?” Sounds WAAAAY better doesn’t it?

-

Together we will figure out where you are starting from if you changed nothing. Are you spending more than you are bringing in each month and adding debt? Do you have money left over, but you don’t know what to do with it?

-

Gone is the fluff advice to “Just stop buying avo toast” We go DEEP into strategy to find more money in your existing budget. Did you know it only takes $416 a month to retire a millionaire?

-

We take a deep dive into all the ways you can budget with an abundance mindset. It’s easier than you think, and you can set it and forget it. This key foundation for all your gains to come will leave you empowered and STOKED to start counting that paper.

-

It’s time to pay yourself first, automate your spending, saving and investing. Your time is precious, it’s time to spend and save smarter.

Module Three

Debt Management: Debt, the big bad money wolf we are all hiding our wallets from. And it’s true, some types of debt CAN be bad, but debt can also be a powerful wealth building tool. In this module you will learn how to use debt to build wealth, leverage money and propel your financial growth.

(Would you believe me if I told you that I added over $1 million to my Net Worth using debt? Clutch your pearls, it’s true!”)

-

So, imagine you've been shopping, booked a vacation, signed up for a pottery class or needed a repair on your car. Often, we end up using credit cards or taking out loans to pay for these things, and that's where consumer debt comes into play.

-

Debt is really just a catch-all for a multitude of ways to spend someone else’s money (usually a bank) and knowing how to view some types of debt as Leverage is one of the rich people secrets you NEED to know.

-

So you have debt, we’ve ALL been there. Let’s replace the stress with tools and a plan. “Pay off the debt” Is not helpful, I will tell you the then show you the steps to what actually works.

-

Rich person hack time. We will analyze with examples how to decide if you should borrow money for a purchase or use your cash. The difference between the two can be thousands of $$ added or subtracted from your Net Worth . Don’t wing it.

-

APR, Minimum Payment, Grace Period, Cost of Funds, Credit Utilization, Points, Credit Score and more. All the boring stuff you need to know to use debt the right way.

Module Four

Retirement Accounts: The Average American needs $1.53 million to Retire. Retirement accounts, as the name suggests, are specifically designed to help individuals save and invest for retirement. In this model we will cover ALL types of retirement accounts, HOW to choose the right one and the ORDER in which to use them.

Ever dream of laying on a beach on the Amalfi Coast sipping pinot gris in the sun? Then a Retirement Account should be your Roman Empire.

-

100% of women need an IRA. The decision between a Roth or Traditional depends on age, tax bracket, income and goals. I’ll clearly lay it all out.

-

Thanks to Uncle Sam, retirement accounts have a LOT of rules related to income, contributions, taxes, distribution etc. In this Module, we will cover what all of them are.

-

Did you know a 3% match on the average salary is HUNDREDS of thousands of $$ by the time you retire?! Make sure you are getting every cent they offer you in compensation by maxing out your match options.

-

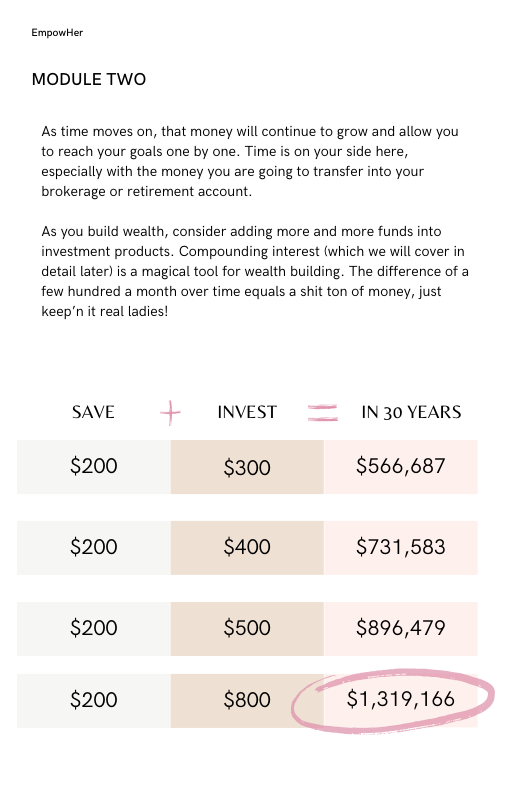

Compounding interest is probably the single most important concept to understand for all financial health and wealth. We’ve got full breakdowns with repeatable examples. Notice the pattern yet?

-

This Module will cover all the different retirement account options you have, and then give you a step-by-step plan for you to follow. I wouldn’t leave you hanging, we are besties at this point.

Module Five

The Ins and Outs of Investing: Now that we have nailed our budget, started saving for our emergency fund, maxed out our retirement options…. what next?

Now entering the group chat: Investment Portfolios. This is where things get really fun and we start BUILDING wealth by investing. I will cover types of accounts, investments you can buy how to choose them, immediate check-in and long term plans, a deep video dive into a fund and give you a bullet point list of what to look for when you go to buy.

We will end the module with a step-by-step plan leaving no room for confusion or doubt.

-

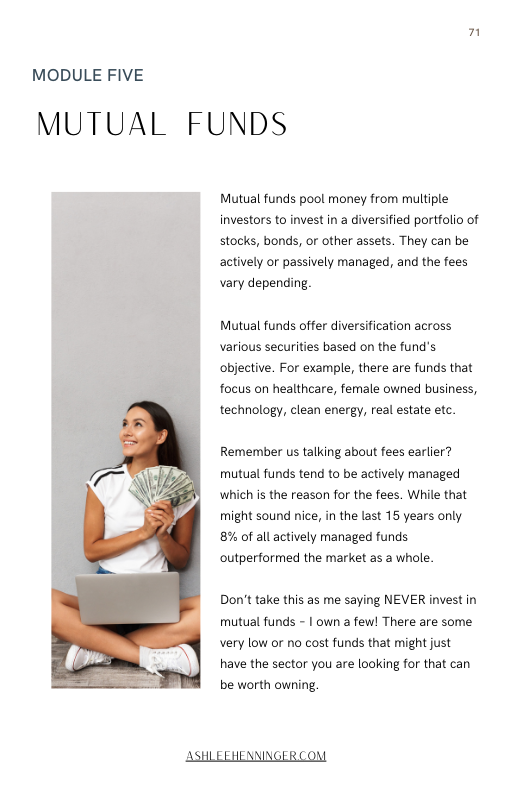

A brokerage account allows you to buy and sell a wide range of investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs) and more. Don’t worry, you’ll make all of these your B by the time we are done.

-

Now things are going to get really fun. Don’t worry, there isn’t any “stock bro” vibe here just pages full of all the tools to help you get that money honey.

-

I’m just not a surface level person in life or investing. All too often, women are told that we wouldn’t possibly understand, or this is for “men” or we can let someone else do it for us. NO THANKS. I know you are smarter than that, and I know this is the knowledge you need. We do a DEEP dive into a fund and cover all you need to ever know (in video, text and photos so you’re fully equipped.)

-

You will leave this module knowing WHAT to buy, WHEN to buy it, WHY to buy it, WHERE to buy it, HOW to buy it. We will also cover how to analyze and adjust as your money grows. You will leave this Module with everything you need to claim “millionaire” as your new bio line. This is where the magic happens, this is the life changes sh*t that turns me into a raving lunatic trying to share it with every woman I know.

-

Nothing is left to chance, your future depends on it. One last circle back to you step by step retirement and investment plan just to be sure you’ll be repeating it in your sleep.

Module Six

Real Estate: It is estimated that over 90% of all millionaires invest in some form of real estate and for good reason. While real estate can (and does) ebb and flow in value over time, it can be one of the most secure long term investments. Home ownership is within reach for the average person, and in this module we will cover how to prepare yourself, how to determine how much you can actually afford, what downpayment makes the most sense and how to leverage the mortgage lenders money to build long term wealth.

Want to get me really amped up? Talk to me about Real Estate. I’m really fun at parties, I swear.

-

Most people ask the WRONG questions and do the wrong preparation when buying a home. 90% of people regret one element of their home purchase. You won’t be one of those people.

-

How much home you can afford is a lot less about the payment and a lot more about EVERYTHING else. Confused? So are most people. You will learn the 5 most important questions to ask yourself that have nothing to do with the payment.

-

We will break down all the mortgage options and cover questions to ask, red flags, loan programs and pre-approvals. Be warned, mortgage paperwork looks like a college dissertation but after we cover the key elements you’ll be 20 steps ahead.

-

You will get a chance to apply all the skills you learned in Module 2+3 about leveraging debt to build wealth. Putting 20% down on a house can be an outdated strategy in a lot of situations. (I’ve never put 20% down on a house)

-

I encourage (and wish I could require!) first time home buyers to consider house hacking. There are many ways you can do this, but all of them allow you to purchase a home you might not be able to afford just on your income. This let’s you increase your leverage, and increase your equity (profits) at a higher rate.

Take A Sneak Peek Inside EmpowHer

Here are some epic value packed bonuses to leave you thinking there is no way I actually get ALL THIS.

Fully Customizable Year Long Budget Template

-

Download and save to your computer, this budget template is fully built out to help you track your progress and your hard earned dollars.

Office Hours!

-

Get 3 emails back and forth with Ashlee. Ask ANYTHING you want from budget advice, follow up questions or just connect with a like minded baddie like yourself.

Full Financial Glossary

-

Full glossary of every finance term you need to know but should not have to spend a second googling or memorizing. Save it to your phone!

EmpowHer was made for YOU

This is the only program you will ever need to join the other badass 7-figure net worth women who are kicking ass, taking names and building a better future.

Take a glimpse into your life EmpowHer’d:

Your budget is set and working for you. Every month you know exactly how much you are spending on expenses, entertainment and investing. Every quarter, you check in and see if things have shifted. If so, a couple quick tweaks get you back on track.

Every month your debt is getting smaller and smaller. You know exactly which debt to pay off first and how much to pay each month. You have a PLAN and a timeline. Bills come in but the panic doesn’t! You’ve GOT THIS.

Financial stress is a thing of the past. Your emergency fund is set up and available if needed. Every month, your savings and investment contributions are automatically transferred into their respective accounts.

You are going to retire a MILLIONAIRE (and highly likely, a multi-millionaire) because retirement planning is your new found super power. You know when it’s time to buy, what to buy and how much to buy to maximize profits.

Welcome to the next level of wealth creation. The budget, debt payoff, savings and retirement planning has all worked as it should. Now you get to watch the money grow in your brokerage account, learn about new markets, asset classes and fund categories for FUN. You’re a financially savvy queen by now.

Home ownership is now within reach for you. Real Estate is a wealth building tool that you plan on using. You know exactly where to start, how to choose your downpayment and what is included in a mortgage. You also know how equity will benefit you in the long run, and plan to house hack your way to financial freedom.

WOMEN

generate a higher return on their investments consistently outperforming men

85%

of brand driven consumer purchases from cars to healthcare are decided on by women

BY 2028

over 75% of all GLOBAL discretionary spending will be controlled by women

Female CEO’s

of S&P 500 companies report greater profits than companies run by male CEO’s

imagine what money could change for you

imagine what money could change for you

LIMITED TIME INTRO PRICING: Get anytime access to our comprehensive 6-module "Done For You" Finance Degree. Inside you will strategies and actionable steps to go from stress and confusion to clarity and wealth stability. Includes a DEEP dive into: Debt, Budgeting, Retirement Accounts, Investment Products, HOW to Invest, Real Estate and MORE.

Women just like you who did the damn thing:

“2020 destroyed me financially. I lost my job and ended up having to move unexpectedly. I had been trying to pay off debt on my own and figure out how to start over and it wasn’t going great. EmpowHer gave me a clear plan to pay off my debt, start saving and investing at the same time. Having the big picture was the game changer for me”

Zoey

“I felt like a failure in all my attempts to be independent with my money. The stress wasn’t good for my mental health and I decided to make a change. Knowing how to invest and in what order was something that I didn’t even know was missing from my strategy.”

Maddie

“I always knew the basics of budgeting finance etc but never knew how to do much past that. Having all my steps in one place has been SO helpful, I reference back to this guide often.”

Jenna

“My partner and I had a plan to buy a house in 2023 but got overwhelmed with the process and just stopped looking before we even started. Now I know where to start, and how to find the right people to help us. Based on the budget we built, buying a house should be possible for us in 2024.”

Stacie

FAQs

-

Perfect, then you’ve come to the right place. We start at square one, and will cover EVERY part of building a budget primed to help you build wealth. From how to collect the data, how to organize it and how to track it (in your BONUS budget template) we will cover it all. A lot of people know WHAT to do, but they don’t know HOW to do it. This isn’t just a fancy list of what to do, this is an in depth guide on exactly HOW to take these steps. We cover multiple scenarios and multiple strategies for how to accomplish your goals.

-

Understanding how to leverage debt is an important skill in the wealth building journey. We cover how to analyze interest rates, understand APR, grace periods, repayment terms and more. Utilizing debt to your advantage is a skill that most people are missing, but you won’t be one of those people! Once your Budget, Debt Payoff, Savings and Financial Plan is in place, then the growth begins.

-

100%, even if all you can do right now is make minimum payments on your debt or save as little as $5 a month we will show you how to prioritize what to pay off first, what to save for first and how to know when it’s time to change your strategy. When you are ready to start investing, saving for retirement, leveraging your money and growing your wealth Modules 4-6 will not just tell you what to do, but HOW to do it. And here is the best part, by the time you leave Module 3, I can almost guarantee you will have way more money to invest than you thought!

-

We really love this question. Could you go to google and track down ALL of this info yourself? Sure, if you had 20+ hours a week to sift through all the b.s. online, try and understand the financial jargon, look for resources you know are trusted, look at every financial platform out there and try and make sense of investment account types, retirement account types, funds, prospectuses etc. Oh and don’t forget taking the 4 years and $250k+ to get the finance degree. And oh wait! If we are going to talk about real estate, you’d also want to be able to research different loan programs, understand what lenders are available to you, understand home equity, leverage etc etc etc. Tired yet? When we say this program is a DFY finance degree made up of 15 years of real world experience, that’s actually what we mean.

-

Send us an email to hello@ashleehenninger.com or a DM on Instagram, there is a real person ready and waiting to help you!

The sooner you get started, the sooner your money can start to grow (hello passive income). In fact, the S&P 500 grew 10.9% in the first quarter of 2024. So what does that mean?

If you had $10,000 in an S&P 500 index fund between January 2024 and March 2024 your money would now be worth $11,090.

Ummm YES PLEASE

I know we don’t know each other yet, but you can probably tell that I am a no b.s. straight to the point kinda gal. That’s what this program is, it’s EVERYTHING you need and nothing you don’t and that’s why it’s different from anything you have tried before. And while I can’t guarantee the results you will have, I can tell you this. For the past 100+ years, the strategies I teach have worked. They have turned everyday women just like you and me into millionaires. They have awarded time freedom, resources and choice that has lead to businesses being started, families stabilized, wealth created, passions pursued and dreams manifested.

Now it’s your turn.

SOME CLOSING THOUGHTS…

(BUT WHO AM I KIDDING, I WON’T STOP UNTIL I HAVE REACHED EVERY WOMAN ON PLANET EARTH)

I want you to imagine this scenario. You’ve given 110% to your employer for years. You’ve missed kids soccer games, skipped out on happy hours with friends to meet a deadline, drug yourself out of bed for a 5am work trip, settled for the 3% annual raise and hoped for the best. You earned a decent paycheck, but you never really watched where the money went and that email HR sent about a 401k plan got lost between a reminder to renew your car warranty and a newsletter from your kids school.

And then it happens, you get the call from that boss you always killed yourself to impress. Downsizing, budget cuts, not your fault, 2 weeks severance. SHIT

Or this…

You’ve always dreamed of owning your own business. You’re passionate about women’s wellness, and you feel like you have a calling to fill in the gaps left by our healthcare system. You decide that in order to start your business you need to save up a nest egg so you can tackle things head on. You take a job that pays decent and vow to “save all you can” but something isn’t clicking. A year goes by, and your bank balances look the same. Two years go by, and while you paid off some credit card debt and stopped buying iced coffees (because that’s what everyone says keeps us from wealth right?) your bank balances still look pretty much the same. Three years go by, and you saved up a few thousand dollars but then your car breaks down and that bill comes in. By the next month your bank balances look, you guessed it…pretty much the same. But what the hell is going on? You’re working, trying to “save” and traded your grande flat white for a Folgers flat blah . That’s what everyone says to do, so why isn’t it working?!

Here is the hard truth.

Almost all the women I meet who know they want to be financially stable are currently trading time for money, because IF YOUR MONEY DOESN’T WORK FOR YOU, THEN YOU WILL ALWAYS BE WORKING FOR YOUR MONEY.

ENTER THE RAVING LUNATIC doing everything I can short of an Apple Music 2014 auto adding a U2 album to your phone to make your story DIFFERENT…p.s. if anyone knows a way to just auto upload all this info into every woman’s brain I’m all ears so DM me.

Financial stability is the single most critical but self-controllable element in a fulfilled life. The key here is SELF…the key here is YOU.

YOU + ME … It's that can't eat, can't sleep, reach for the stars, over the fence, World Series kind of stuff.

Love you, mean it